missoula montana sales tax rate

Missoula is located within Missoula County Montana. The Montana sales tax rate is currently 0.

Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----.

. The Montana State Montana sales tax is NA the same as the Montana state sales tax. The East Missoula sales tax rate is 0. The Missoula sales tax rate is.

There is 0 additional tax districts that applies to some areas geographically within Missoula. Montana Sales Use Tax Information. The most populous zip code in Missoula County Montana is 59801.

The December 2020 total. 0 State Sales tax is -----NA-----. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----.

The sales tax rate does not vary based on zip code. A full list of these can be found below. 59812 - State Sales And Use Tax Rates -.

The 2018 United States Supreme Court decision in South Dakota v. The County sales tax rate is 0. Base state sales tax rate 0.

56 rows The state sales tax rate in Montana is 0000. There are additional taxes. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

While the base rate applies statewide its only a starting point for calculating sales tax in Montana. The Montana MT state sales tax rate is currently 0. Has impacted many state nexus laws and sales tax collection requirements.

Has impacted many state nexus laws and sales tax collection requirements. There are no local taxes beyond the state. The County sales tax rate is.

17 hours agoA Missoula development team has plans for a massive 30 million development in the central part of town featuring 132 housing units 20 of which will be set aside for people earning 80 or below. The Montana state sales tax rate is currently. The Montana State Sales Tax is collected by the merchant on all qualifying sales made within Montana State.

Wayfair Inc affect Montana. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. 4 rows The current total local sales tax rate in Missoula MT is 0000.

The 2018 United States Supreme Court decision in South Dakota v. Download all Montana sales tax rates by zip code. Wayfair Inc affect Montana.

It would not exceed 4 similar to the 2019-approved resort tax rates for Montana. Also some other Consumption taxes such as Vendor Tax Consumer Tax etc. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected.

The Missoula Montana sales tax is NA the same as the Montana state sales tax. 362 013 341st of 3143 093 003 1250th of 3143 Note. The Missoula County sales tax rate is.

Montana has a 0 sales tax and Missoula County collects an additional NA so the minimum. Sales tax region name. 2022 Montana state sales tax.

Montana has no state sales tax and allows local. If you need specific tax information or property records about a property in Missoula County contact the Missoula County Tax Assessors Office. Montana has no sales tax.

The Missoula sales tax rate is NA. If the local option sales tax were to pass it would be enacted for 10 years unless residents vote to repeal it during that time. Did South Dakota v.

Within Missoula there are around 8 zip codes with the most populous zip code being 59801. The sales tax rate does not vary based on zip code. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax.

Sales Tax and Use Tax Rate of Zip Code 59803 is located in Missoula City Missoula County Montana State. This page provides general information about property taxes in Missoula County. 368 rows Average Sales Tax With Local.

The 2018 United States Supreme Court decision in South Dakota v. The combined sale tax rate is 0. SB313 outlines local sales tax proceeds to be split with 50 allocated to infrastructure affordable housing and administration.

The average cumulative sales tax rate between all of them is 0. Get a quick rate range. The sales tax rate does not vary based on location.

While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected. To review the rules in Montana visit our state-by-state guide. For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate.

5 sales tax in Richland County 20000 for a 20000 purchase Missoula MT 0 sales tax in Missoula County You can use our Montana sales tax calculator to determine the applicable sales tax for any location in Montana by entering the zip code in which the purchase takes place. Montana is one of. Has impacted many state nexus laws and sales tax collection requirements.

Sales Tax and Use Tax Rate of Zip Code 59806 is located in Missoula City Missoula County Montana State. Did South Dakota v. There is no local add-on tax.

Montana state sales tax rate. Exact tax amount may vary for different items. Sales Tax Rate Lookup.

Sales Tax and Use Tax Rate 2022 - description are given below. 0 State Sales tax is -----NA-----. The Montana sales tax rate is currently.

The average cumulative sales tax rate in Missoula Montana is 0. This includes the rates on the state county city and special levels. Tax rates last updated in April 2022.

The most populous location in Missoula County Montana is Missoula.

Faqs Fy2021 Budget Engage Missoula

Our Experienced Advisers Can Help With Hongkong Staff Employment Regulations And Contractual Terms To Internal Communications Business Names Human Resources

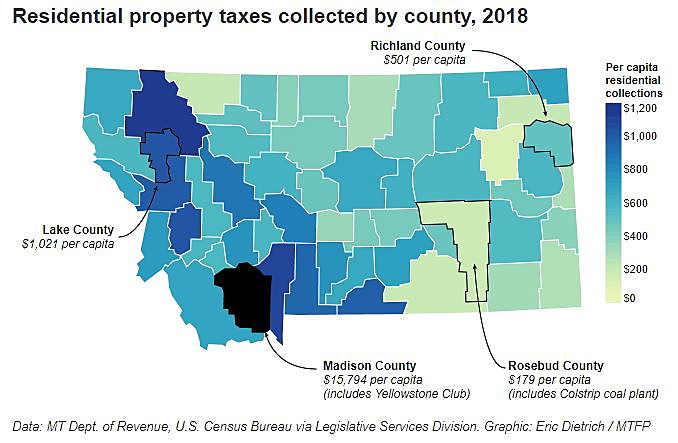

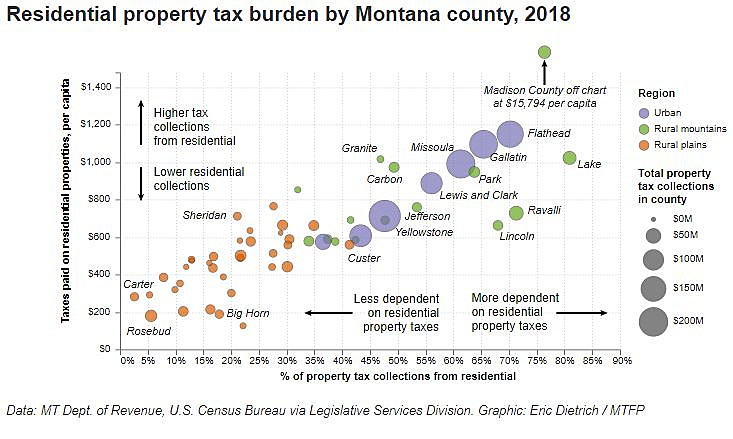

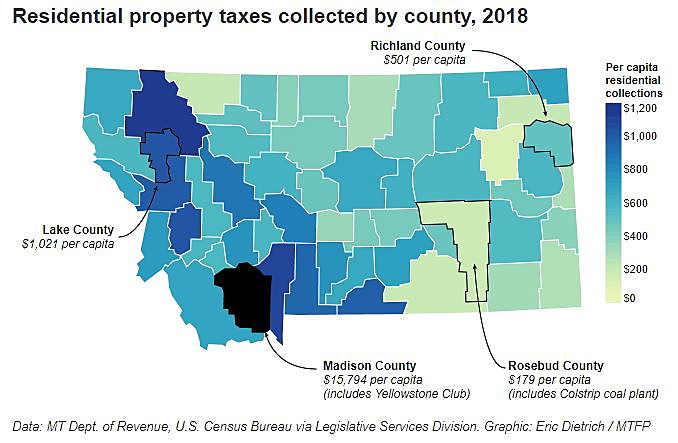

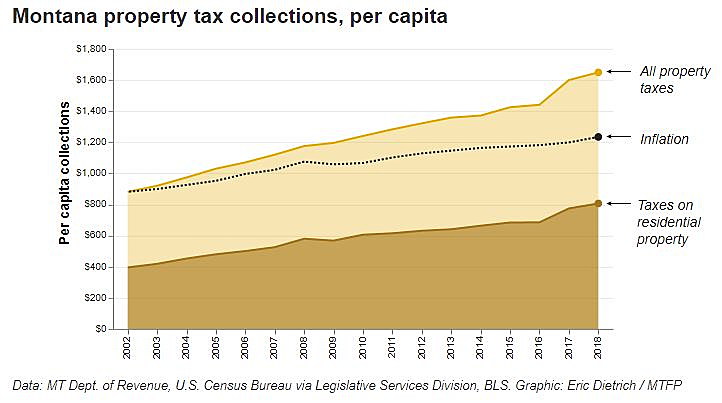

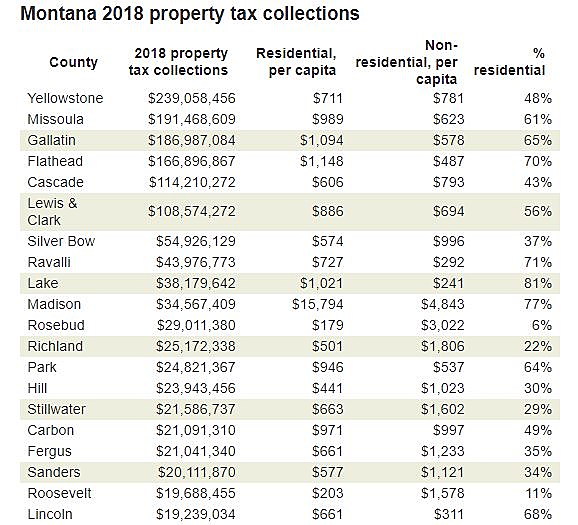

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana S Passing A Ferrari Tax On Tax Evading Montanans Find Car Meets

Montana Income Tax Mt State Tax Calculator Community Tax

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Income Tax Mt State Tax Calculator Community Tax

Montana Sales Tax Guide And Calculator 2022 Taxjar

Montana Income Tax Mt State Tax Calculator Community Tax

Montana Chamber Of Commerce Holds Listening Session In Missoula State Regional Helenair Com